Award Holder: Farah Qureshi

University: University of California, Irvine

Title of Research: Financial Inclusion, Political Inclusion, and Social Belonging in Kenya.

This investigation examines the logic and application of ‘inclusion’ projects in Kenya, which aim to repatriate wealth or attract investment to the country. By studying circuits of capital and payment flows in the context of Kenya’s colonial, racialised, and diasporic histories, this research considers how such inclusion practices actually create or exacerbate exclusions. Through focusing on financial accessibility and divisions, this research looked at what the ‘inclusion’ agenda means in Kenya, and how it can reveal historic divisions through racial capital.

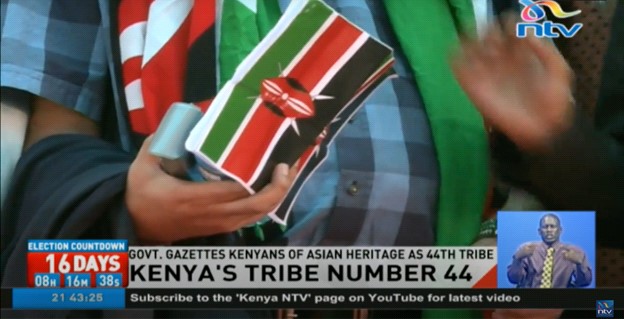

In recent years, the Government of Kenya has proposed a series of national development plans, such as Vision 2030 and Building Bridges Initiative (BBI). These plans are nation-branding exercises, a concept explained by Yan (2003) as promoting utopic imaginings of a nation. This PhD research focuses on two inclusion movements which fall under the scope of these idealistic logics. The first is a ‘financial inclusion’, which encourages financial innovation through financial technology (fintech) culture and innovation hubs. The second is a ‘political inclusion’ of the Asian population, who—just before the 2017 national election—received acknowledgement as a Kenyan tribe. Both movements are economically motivated, aiming to broaden the size and wealth of the Kenyan economy through attracting business and financial growth, or a repatriation of Asian wealth.

Historical documents reveal how previously unified transaction systems were divided through colonial segmentation. These separations formed the foundations of contemporary wealth and prosperity networks. Racial and ethnic divisions are historically arranged but reproduced in contemporary financial accessibility and wealth. Geographic spatial segmentation and racially exclusive financial institutions during colonial rule established separated Asian economies, which are still exclusive.

Kenya’s innovation and technology hubs fuel and inspire a culture of innovation and technological development, but are dependent on similar exclusive networks. Despite the inclusive labelling connected to technological innovation, participation and success depend on networks. Instead, historically dispossessed citizens are continuously marginalised with predatory digital finance options. Comparing Asian entrepreneurship and financial participation against the culture of innovation and technology hubs revealed exclusive networked spheres of exchange. Success and mobility in these networks reproduce historical divisions.

The following report will outline both my research methodologies before and after the Covid pandemic, while also outlining some research findings and theoretical contributions.

Figure 1: News broadcasting categorisation of Asians as a tribe in 2017, just over two weeks before the election.

Methodologies and data collection

Pre-Covid research

Under the assumption of performing at least ten months of fieldwork in Kenya, alongside a supporting two months in archives in London, my research design was originally organised according to standardised ethnographic research methods. Following four months of preliminary fieldwork, I had planned to collect within a period of one year:

- Participant observation across multiple sites in Nairobi to observe the organisation of financial structures.

- Archival research at the British National Archives, Kenyan Archives, British Library, and the Parliamentary Archives.

- A novel “follow-the-money” journal tracking and survey, to understand which forms of payments are used by which groups of people. This involved recruiting respondents to record journals for two days a week over a three-month period.

- Semi-structured individual and group interviews from a diverse range of participants.

- Oral history interviews.

Research during the Covid-19 Pandemic in 2020

The Covid-19 pandemic meant I had to make an abrupt exit from Kenya in March 2020. This move disrupted my original fieldwork plan and interrupted all of the above forms of data collection. Some longer-term plans such as the follow-the-money journal collecting or oral history collections were halted. While I had originally planned to return to Kenya, I worked with academic advisors and my RAI mentor Paul Lane to reframe my research methods and continue to collect data while positioned in the UK.

I could not continue physical participant observation, but switched to virtual observation through online arenas such as Facebook groups, Reddit discussions, and YouTube videos and comments. Working remotely allowed me to increase the number of interviews I collected, as every Zoom conversation I organised could be recorded. Respondents spoke about changes they were witnessing in the country through the national Covid response, and their own personal experiences with their work and networks.

In lieu of group interviews, I designed a detailed questionnaire which could be shared with multiple respondents across the country. The scope of reach in the answers were broader, and comment boxes tagged on to every multiple-choice question allowed a collection of qualitative information from survey participants.

To help connect with more discussions on the ground, I hired a research assistant in Kenya who was able to find additional respondents, and collected articles and grey literature such as government statements responding to the Covid pandemic. Without his support and contributions, I would have only observed a thin and shallow impact of the pandemic in Kenya.

Figure 2: An innovation hub in the University of Nairobi, with the words “Say hello to the future” on the wall.

Theoretical contributions and analysis

This project considers how anthropology can think about financial and political inclusion in the context of colonial, racialised, and diasporic histories shaping the modern African nation-state. My findings confront dominant social discourse focusing financial inclusion on the improvement of poor Black economic mobility in Kenya, showing how the processes of technological development and success relied on historically reproduced networks of wealth. The impact is wider than the common discussion, as the platforms created exacerbate wealth inequalities.

While Covid disrupted my physical presence in Kenya, I was able to follow how the country’s aggressive response to the pandemic tested the ‘inclusive’ platforms developed in recent years. A national curfew and cessation of inter-city travel limited wealth and income options for many, and separated many families. Social financial practices such as group savings and social payments almost completely collapsed. Meanwhile, the pandemic itself led to a national push for universal adoption of virtual digital payments instead of cash to limit the potential spread of Covid. People were encouraged to switch to mobile payments or credit cards, forcing many to enter the fold of fintech representation for the first time.

To understand the adverse impact, consider the aggressive nature of many of these fintech start-ups and legacy financial institutions which are increasingly displacing conventional financial services. A second wave of fintech firms began to offer digitally-distributed consumer loans after early fintech firms had introduced digital money transfer services that facilitated cash distributions among users. With unrestricted opportunity to borrow through ever-expanding fast loan options available through fintech mediums, predatory lending practices and never-ending debt cycles are only encouraged.

I argue that financial inclusion is a derogatory classification, often looked at as mobilising the world’s poor as financial consumers (cf. Hann, 2011; Maurer & Mainwaring, 2016; O’Reilly, 2005). While the ‘inclusion’ part of financial inclusion agendas is ostensibly about expanding access in the name of poverty alleviation, the processes by which inclusion happens are fraught with real and potential dangers for consumers. Anthropologists such as Kevin Donovan, Emma Park, and Sibel Kusimba have criticised the uptake and application of fintech platforms in Kenya, which have exacerbated debt relations through predatory lending.

Donovan and Park (2019) shared harrowing narratives of aggressive marketing campaigns by text message that entice borrowers already consumed by ‘perpetual debt’ to borrow at expensive, ballooning interest rates. In the event that they fail to repay the loans, borrowers are harassed with incessant and embarrassing payment alerts on their mobile phones. Cash-strapped borrowers who lack the resources to meet their daily expenses enter a downward spiral of indebtedness.

Aggressive social restrictions imposed in the Covid-19 pandemic shortened cash availability to many, and demand for payday loans and private sector credit loans from businesses looking for working capital skyrocketed in 2020. Some entrepreneurs commented that private foreign investment almost completely disappeared as the country’s economic future beyond the Covid pandemic remained uncertain. Supports provided such as a short-term elimination of M-Pesa processing fees for any payment below 1000ksh (US$10 or GB£7 at the time of writing) were short lived. Many mobile money agents remarked that fewer transactions were taking place, as people had no money to send (Kusimba 2021).

My earlier fieldwork observations revealed that many Asians in Kenya were familiar with mobile money, but not subscribed to the platform to the same degree as other citizens. In 2020, many individuals in the Asian community were forced to use mobile money for the first time, while others began to use the platform in more diverse ways. Reactions from respondents towards this move were varied, but powerful. The Covid crisis may have, in this sense, forced more people to adopt fintech platforms. Despite historic resistance, the push for virtual money usage in 2020 ‘included’ many within the fold of alternative financial services. Respondents were both resistant to the move and welcoming. Many business owners restructured their payroll services to send money through mobile methods, simultaneously forcing employees to adopt the system.

Harvey and Knox (2016) describe an ‘enchantment of infrastructure’ to achieve development ambitions. Kenya’s culture of innovation and development is prioritised through the enchantment of fintech. The recent inclusion of Kenya’s Asians into this arena has shown not to unify historical legacies of distinction and difference, but present interesting avenues of additional research. Social scientists have shown that concepts of race and ethnicity shape and are shaped by digital technologies (Nakamura & Chow-White, 2013, Diamandaki, 2003). I aim to continue following how these divisions are reproduced in contemporary financial access.

Challenges

While I had conducted preliminary fieldwork and have a personal connection to Kenya having lived there as a child, I still found the experience of starting fieldwork and grounding myself in a daily practice of research very challenging. I made a point of returning to the same few field sites and attended discussions such as panels or public forums to meet a diverse range of people I could keep speaking with.

I found I had an ambiguous identity between certain locations and groups. In many situations I was classified as either local or a foreigner and sometimes both. This ambiguity sometimes affected the quality of discussion when interviewing or meeting some people. A few even assumed I was an investor interested in their projects. Some other respondents assumed that I was a financial assessment analyst, interested in studying how successful M-Pesa and fintech had become in Kenya. In these situations, I wondered if so if many of my respondents were just so seasoned to the repetitive nature of ideological discussions, leading them to tell me answers they assumed I wanted to hear. I was able to navigate this and find more diverse responses with the help of my research assistant and some additional interlocutors.

I found it helpful to connect myself with an academic research centre—the British Institute in Eastern Africa (BIEA)—which regularly held discussions and reading groups, While also hosting other PhD researchers. Connecting to a research Institute allowed me to reflect on my findings with other PhD researchers, and the diverse academic staff at the institute.

Having to leave the field was a very difficult experience, especially as I had to cancel many of my ongoing research connections and lost contact with a large number of respondents. This was particularly distressing while I was trying to navigate research remotely and could not find many new respondents outside of my calls for assistance on virtual forums. However, my decision to adopt remote research and data collection helped me collect enough material to process and analyse in a dissertation.

Despite the distressing consequences of the last year, I feel fortunate to have collected research during this period. Such information will contribute to novel yet important anthropological analyses on the global impact of the pandemic. While I would like to be able to return to Kenya at some point in future, a persisting uncertainty and limitations on travel make this an uncertain option before the completion of my PhD. I aim to continue writing my dissertation, and if the opportunity arises for a return visit to Kenya for supplementary research, I will certainly take it.

I am grateful to the Royal Anthropological Institute for supporting my travel and work in Kenya. I have deep gratitude for my RAI mentor Paul Lane, who has consistently supported my research, connecting me to academic networks in both Kenya and the UK, and helped me redevelop my research process and goals at the point of disruption. I am hopeful that my contributions will provide new perspectives and points of discussion.

Bibliography:

Diamandaki, K. (2003). Virtual Ethnicity and Digital Diasporas: Identity Construction in Cyberspace’. Global Media Journal, 2(2), 26.

Donovan, K. P., & Park, E. (2019, August 14). Perpetual Debt in the Silicon Savannah [Text]. Boston Review. http://bostonreview.net/class-inequality-global-justice/kevin-p-donovan-emma-park-perpetual-debt-silicon-savannah

Hann, C. M. (2011). Market and Society: The Great Transformation Today. Cambridge University Press.

Harvey, P., & Knox, H. (2012). The Enchantments of Infrastructure’. Mobilities, 7(4), 521–536.

Kusimba, S. (2021). Reimagining Money: Kenya in the Digital Finance Revolution. Stanford University Press.

Maurer, W. M., & Mainwaring, S. (2016). Anthropology with Business: Plural Programs and Future Financial Worlds’.

Nakamura, L., & Chow-White, P. (2013). Race after the Internet. Routledge.

O’Reilly, D. (2005). Social Inclusion: A Philosophical Anthropology’. Politics, 25(2), 80–88.

Yan, J. (2003). Branding and the International Community’. Journal of Brand Management, 10(6), 447–456.